The Missing Revenue Layer at Scale

We provide embedded commercial leadership that plugs directly into portfolio companies to de-risk growth at scale. Our work focuses on closing the gap between commercial strategy and financial execution — where margin, momentum, and valuation are most often lost.

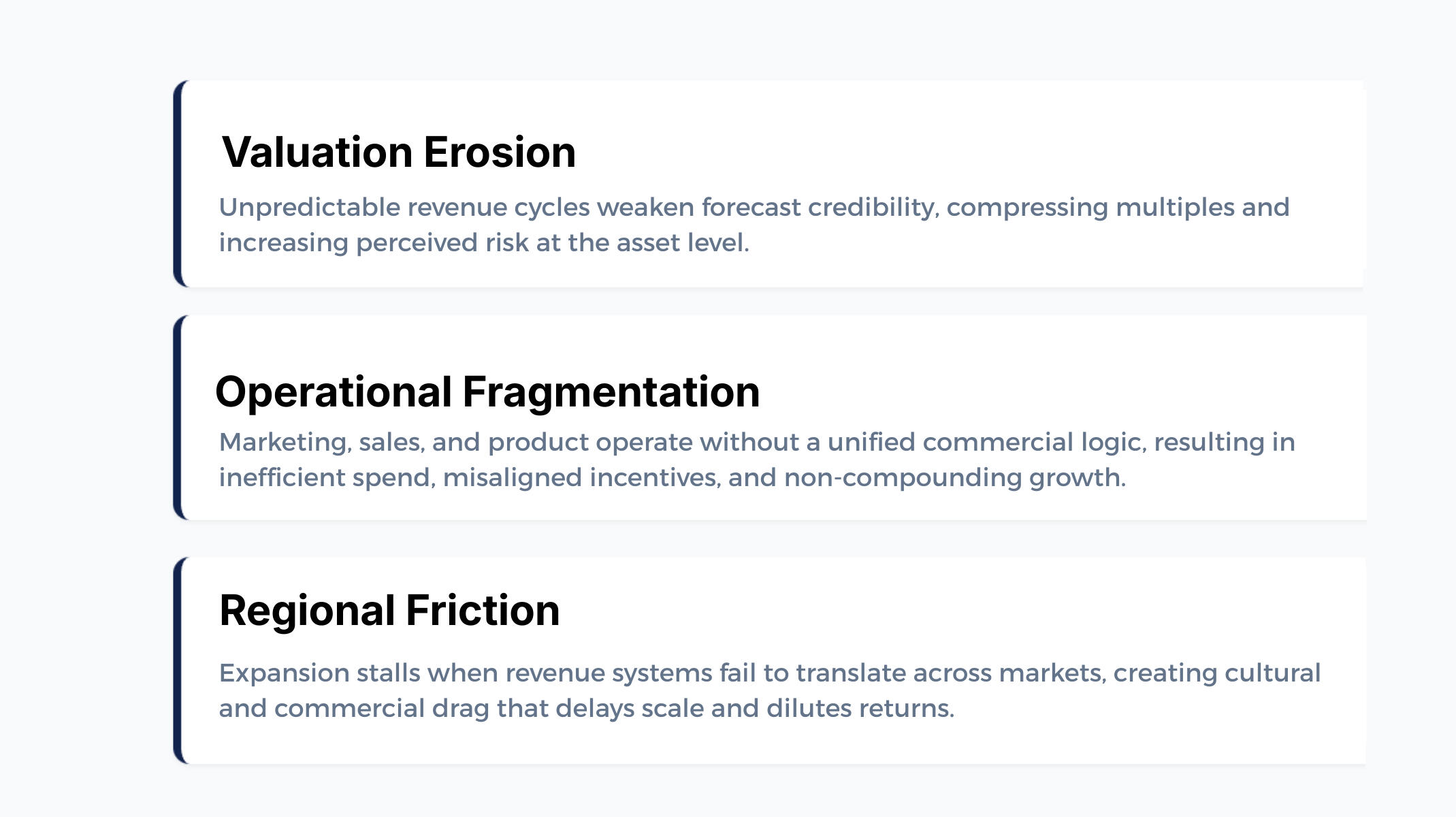

THE HIDDEN COST

Fragmentation Between Strategy and Execution

As companies scale, misalignment between board-level objectives and operating reality introduces structural risk — reducing durability, eroding margins, and limiting EBITDA conversion.This misalignment creates commercial leakage: value erosion that weakens underwriting confidence, delays returns, and quietly compresses multiples. Most organisations respond with more activity. The issue isn’t effort — it’s structural.

OUR APPROACH

A Ready-to-Deploy Growth Engine.

We do not operate as external consultants. We embed as operating partners with decision authority, accountability, and outcome alignment. Our mandate is to restore commercial coherence — so revenue scales without destabilising margin, focus, or valuation.

01

Alignment

We audit the entire customer journey to identify and fix structural "leaks" between that and your revenue capture process. This includes designing the end-to-end solutions and attribution models required to make growth predictable and measurable, while ensuring your organizational foundation is set for success now.

02

Integration

By installing a rigorous strategic framework and the right leadership, we ensure that marketing and sales departments are no longer viewed as "costs" or overhead. Instead, they operate as coherent, unified actions that drive sustainable revenue growth and operational excellence across every level of the business.

03

Implementation

Full implementation and execution: We optimize the revenue engine through your lens of unit economics. By analyzing CLTV and retention cycles, we provide the data-driven proof of ROI that internal teams often overlook, ensuring these are fully deployed in the sales team for maximum effectiveness and results.

04

Handover

We build to last. By identifying and building competitive advantages around your expertise and assets, we leave behind a playbook for you to leverage. Our approach ensures that internal processes are institutionalized so your leadership team can scale the business indefinitely without needing any extra support or guidance.

MEASURABLE IMPACT. INSTITUTIONAL SCALE.

3X EBITDA

GLOBAL PROFESSIONAL SERVICES

57% REVENUE

INCREASED IN MID-MARKET MANUFACTURING

31:1 LTV:CAC

HIGH-CONSTRAINT MARKETS

$48M USD

REVENUE UNLOCKED

+50% PRICE

DECENTRALISED BUSINESS MODEL

100% GROWTH

3-YEAR REGIONAL ALIGNMENT

The Principals

Owner-Led. Outcome-Aligned.The firm is led by Nolan Clack, with senior operating and financial specialists deployed selectively as required. Engagements are structured with clear scope, an upfront operating fee, and incentive alignment tied to measurable commercial outcomes.This work is built for leadership teams and capital partners who require operating control and commercial rigor — not advisory abstraction.

Nolan Clack

REVENUE OPERATING PARTNER

A Revenue Operating Partner with experience across 12 international markets. Nolan works in high-constraint environments and scale inflection points, building revenue systems that protect margins and enterprise value in $20M+ businesses. His focus is resolving commercial breakdowns that emerge as companies scale.

Outcome... not Output

We operate under a high-trust, outcome-aligned engagement model designed for private capital, family offices, and leadership teams managing complexity. Financial modelling, baseline setting, and economic validation are supported by independent specialist partners under success-aligned structures.

Specialized support available for strategic entry and expansion into Latin America and Europe.

© 2026 | North America • Europe • LATAM